With GuidePlan, Your Employees Can Automatically…

Cover unplanned expenses

When Employees Struggle, So Do Businesses.

When employees face financial stress, it hurts your business. Do any of these problems sound familiar?

- Employees turn to their 401k for loans or hardship withdrawals

- Employees ask HR for paycheck advances or loans

- Employees call in sick at the last minute to fix avoidable issues with unexpected expenses

- Employees with untreated health issues have higher healthcare costs

- Employees who struggle with living expenses leave for new jobs with marginally higher pay and support

The Majority of Employees Will Never Take Advantage of Your Financial Wellness Program

It’s not because they don’t need help, it’s because they are ALICE

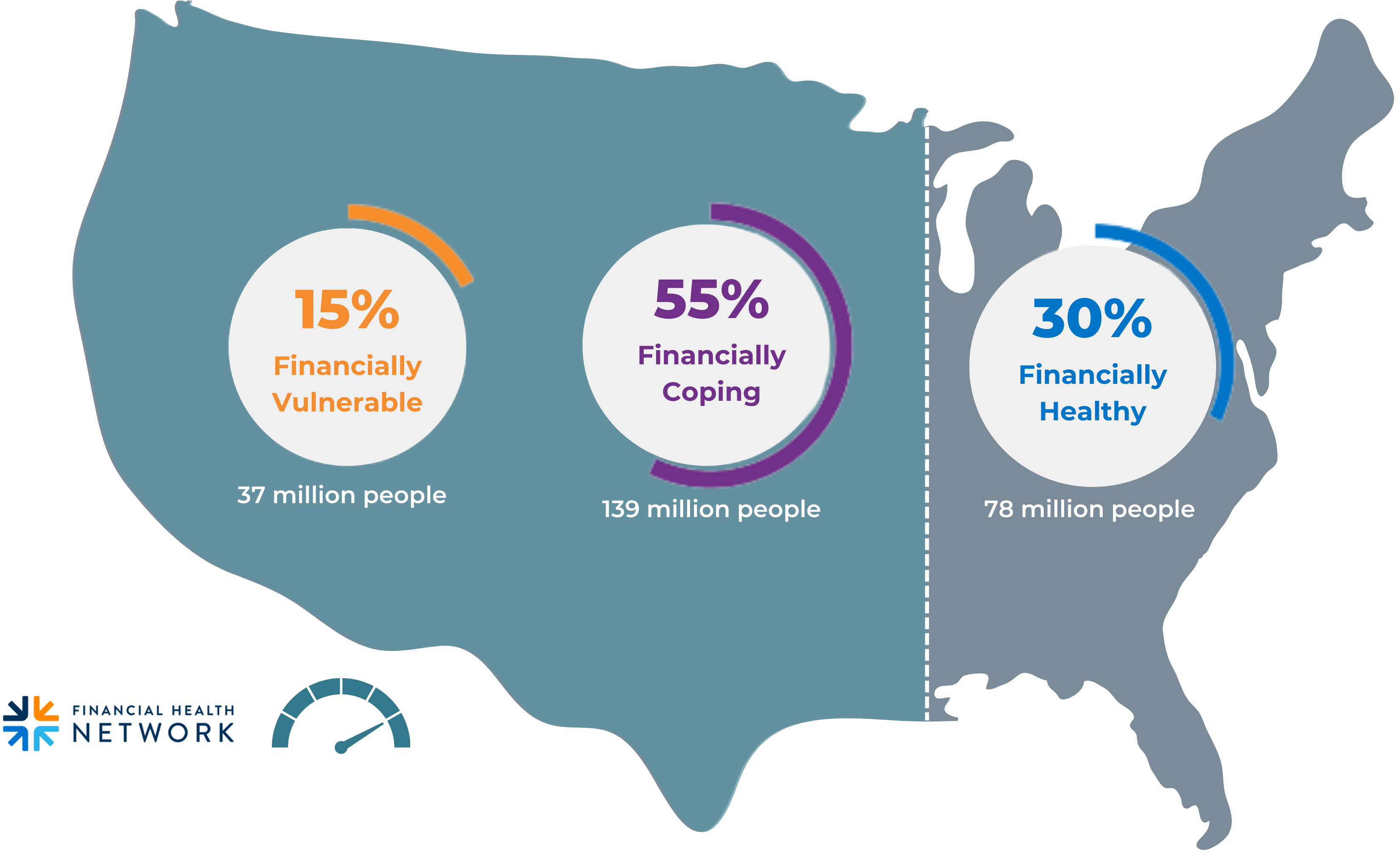

70% of American Households are Struggling Financially

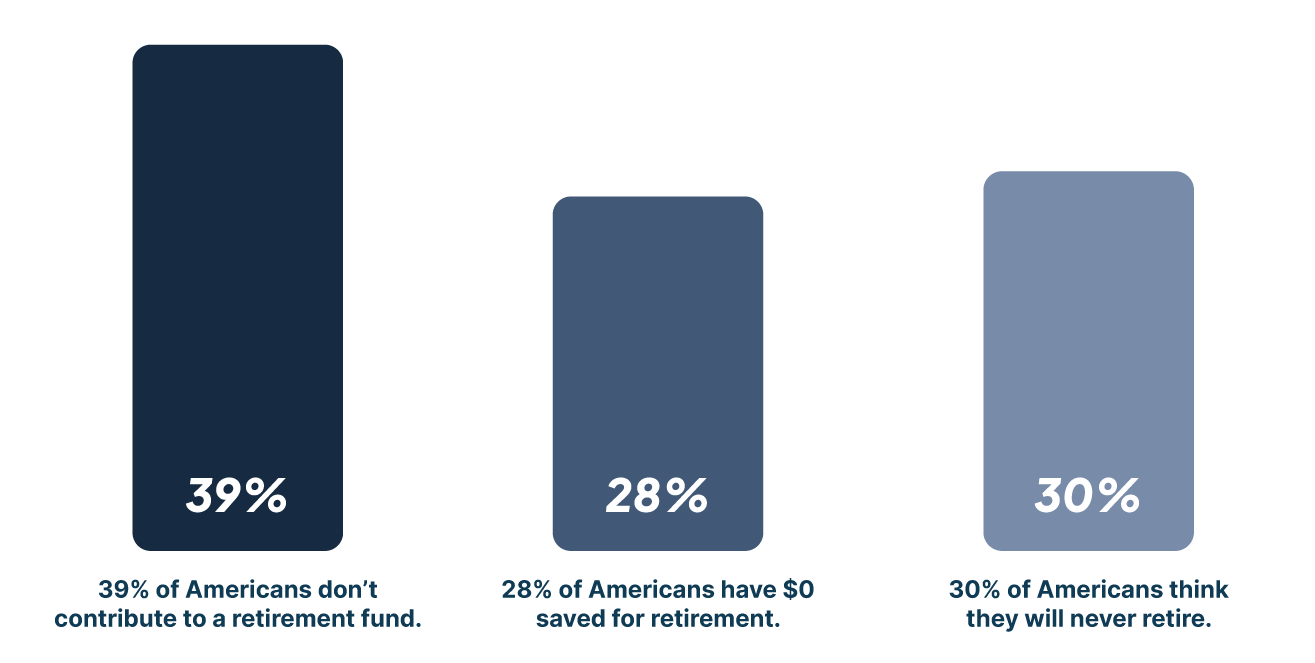

The Average American Has Just

$400 In Savings.

Your Business And Your Employees Deserve To Succeed.

Get A Modern Financial Wellness Solution That Automates Your Employees’ Financial Success.

Unplanned Hardships

Getting Started With GuidePlan Is Easy

1. Schedule a demo

2. Get your customized GuidePlan proposal

3. Sign up and help your employees succeed

Why Choose GuidePlan?

GuidePlan is a modern financial wellness program that puts your employees on the path to financial security by automatically allocating their plan contributions to the right goal. GuidePlan helps everyone create an emergency fund, eliminate debt, build savings, and meet their retirement goals.

Your employees no longer have to feel guilty about not participating because they are focused on other financial goals besides retirement. GuidePlan makes it easy, automated, and incentivized for all employees to take their next steps toward financial well-being regardless of where they are in their financial journey.

Make It Right

Make It Easy

Make It Personal

Easy

Everyone is Auto-Enrolled and Auto-Escalated

Personal

Personalized to the Needs of Each Employee

Smart

Let our software customize a smart, step by step plan.

Automated

Payroll Automates the

Plan

Incentivized

Ability to easily match at each stage of the plan

Mobile

Delivered directly to employees mobile phone

Create Financial Security For Every Employee.

We understand that when your people succeed, so does your business. That’s why, for the past 20 years, we’ve helped hundreds of employers create financial security for their employees through innovative solutions built to address their needs at the source.

Simplify Enrollment And Offer Modern Benefits With An Automated Financial Wellness Plan.

Traditional savings plans are disconnected from 401(k) plans, which leads to a terrible user experience for participants. GuidePlan’s modern plans integrate the best mobile banking and savings with your 401(k) plan to cut out the fluff and guarantee a fluid, personalized experience for every user, rooted in their real-life financial needs.

What You Get With GuidePlan

GuidePlan’s intelligent 401(k) plans provide a single workplace benefit that meets the needs of all employees regardless of where they are on their financial journey. With GuidePlan, you no longer have to hope that people will attend your webinars or watch your video content. All participants receive a personalized plan that inspires and encourages them to take their next step.

Features

With GuidePlan

Without GuidePlan

What You Get With GuidePlan

GuidePlan’s intelligent 401(k) plans provide a single workplace benefit that meets the needs of all employees regardless of where they are on their financial journey. With GuidePlan, you no longer have to hope that people will attend your webinars or watch your video content. All participants will have a personalized plan that inspires and encourages them to take their next step.

With GuidePlan

401(k) Plan

Auto-Enroll

Auto-Escalate

Traditional & Roth Retirement Savings

Modern Secure 2.0 Plan Design

Tax Free Hardship Withdrawals

Access to Payday Alternative Loans

Student Loan Repayment with Match

Debt Management Programs

Access To Affordable Credit & Loan Products

Ability to Save For Major Life Events

Personalized Video Coaching & Content

Smart Videos Delivered By Phone Or Email

Turnkey Solution to Financial Wellbeing for All

Without GuidePlan

401(k) Plan

Auto-Enroll

Auto-Escalate

Traditional & Roth Retirement Savings

Modern Secure 2.0 Plan Design

Tax Free Hardship Withdrawals

Access to Payday Alternative Loans

Student Loan Repayment with Match

Debt Management Programs

Access To Affordable Credit & Loan Products

Ability to Save For Major Life Events

Personalized Video Coaching & Content

Smart Videos Delivered By Phone Or Email

Turnkey Solution to Financial Wellbeing for All

Schedule A Live Demo To See How It Works

If this sounds like something you would be interested in learning more about adding to your retirement plans, the best next step is to schedule a quick demo with our team to go over the product and answer any questions you might have.

Click below to schedule a live demo of GuidePlan.