With GuidePlan, Your Employees Can Automatically…

Cover unplanned expenses

The Majority of Employees Will Never Take Advantage of Your Financial Wellness Program

It’s not because they don’t need help, it’s because they are ALICE

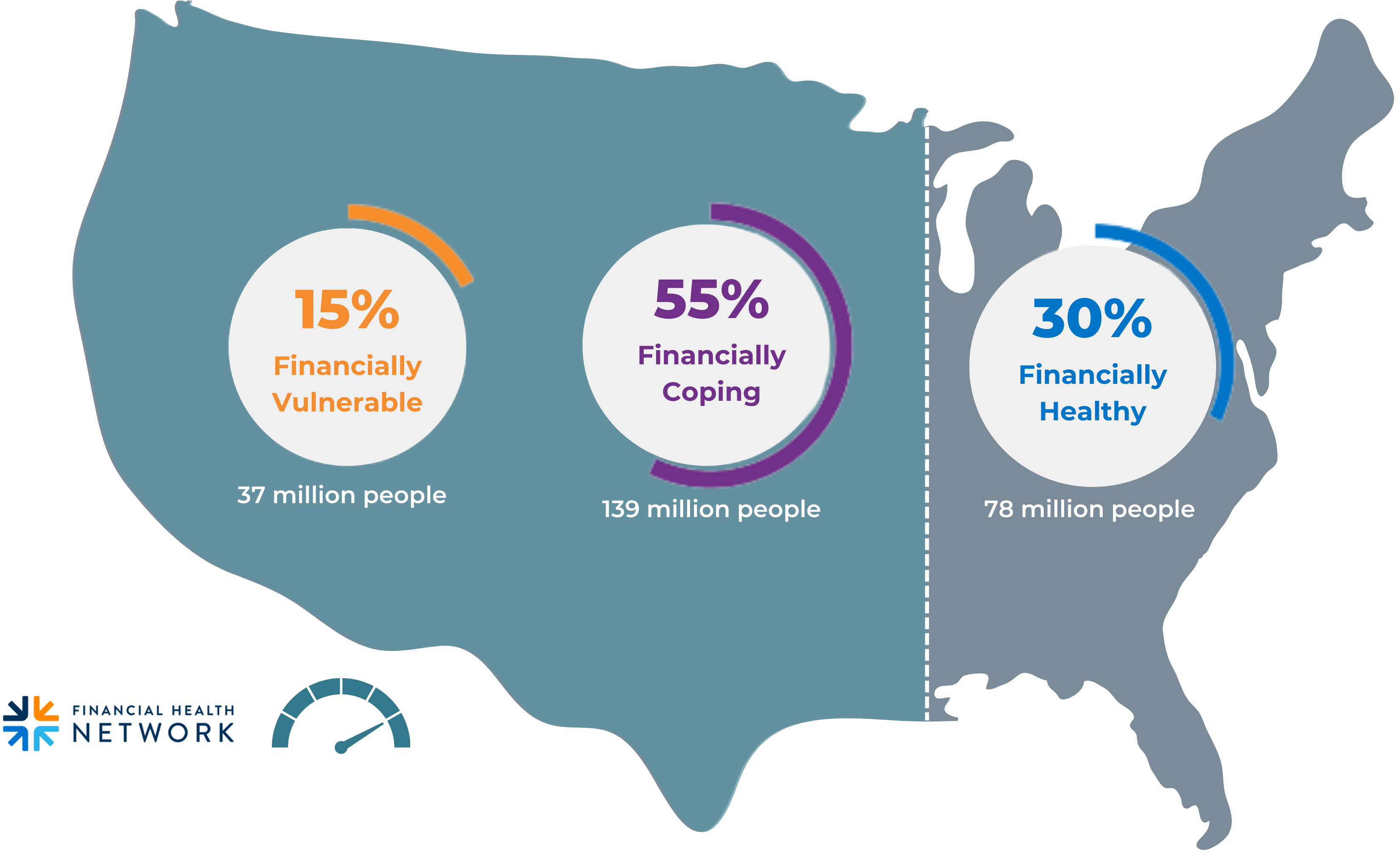

70% of American Households are Struggling Financially

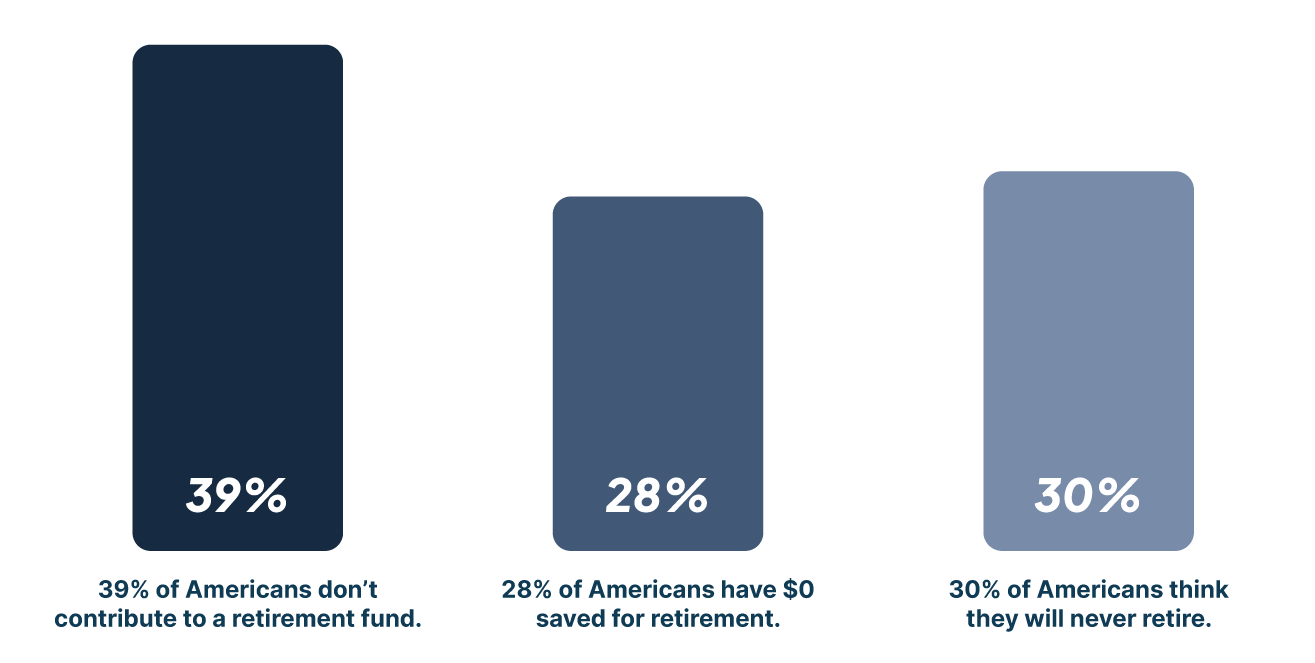

The Average American Has Just

$400 In Savings.

Everyone Deserves Financial Wellbeing

Get A Modern Financial Wellness Solution That Automates Your Employees’ Financial Success.

Unplanned Hardships

Getting Started With GuidePlan Is Easy

1. Schedule a demo

2. Get your customized GuidePlan proposal

3. Sign up and help your employees succeed

Why Choose GuidePlan?

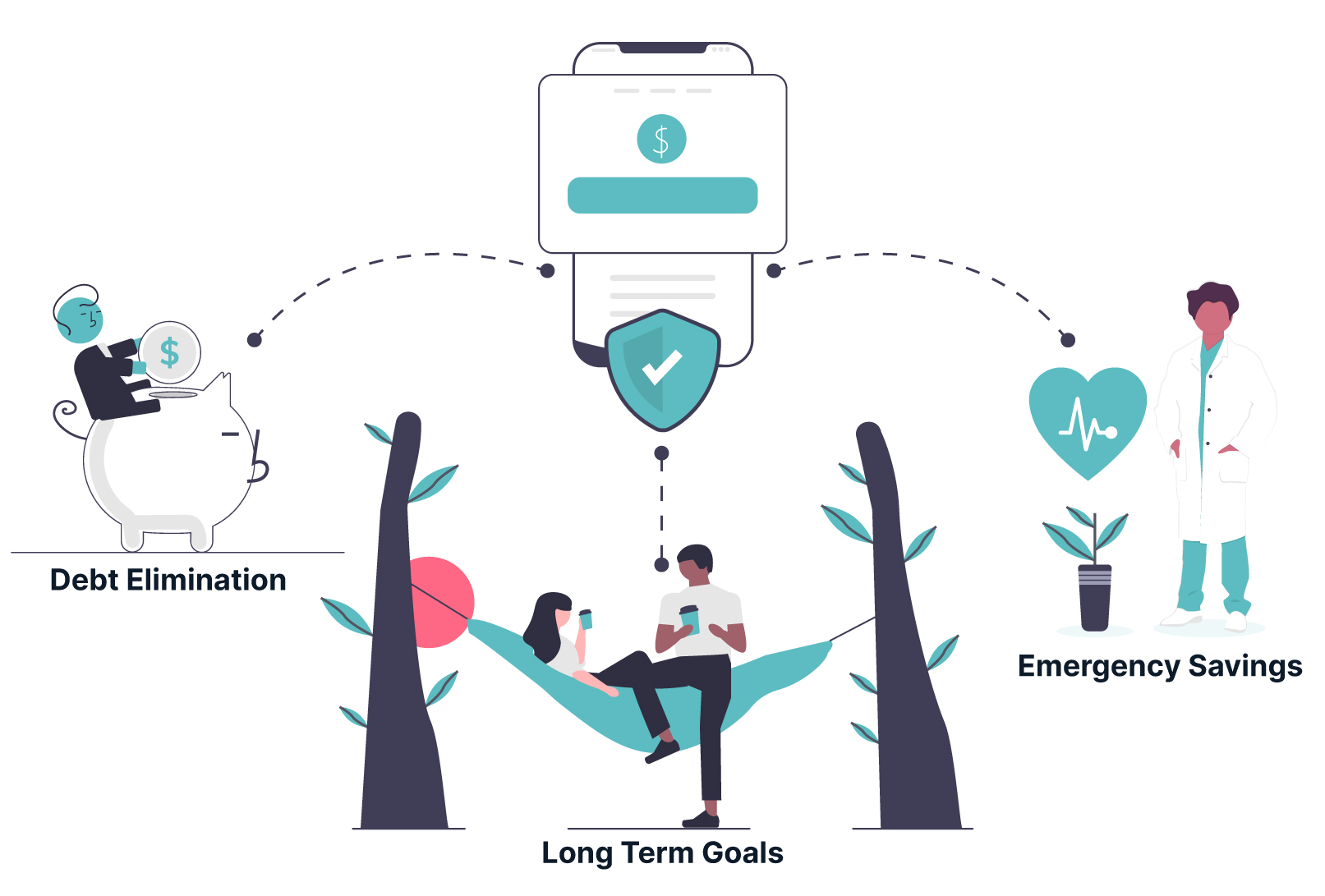

GuidePlan is a modern financial wellness program that puts your employees on the path to financial security by automatically allocating their plan contributions to the right goal. GuidePlan helps everyone create an emergency fund, eliminate debt, build savings, and meet their retirement goals.

Your employees no longer have to feel guilty about not participating because they are focused on other financial goals besides retirement. GuidePlan makes it easy, automated, and incentivized for all employees to take their next steps toward financial well-being regardless of where they are in their financial journey.

Make It Right

Make It Easy

Make It Personal

Place Financial Freedom Within Reach For All Of Your Employees

To do this, we have built a network of partners, including credit unions, community banks, retirement advisors, and employers who all believe it’s important to find solutions that meet the needs of all employees, regardless of their financial status. Not just those who are in a position to make retirement contributions.

What You Get With GuidePlan

GuidePlan’s intelligent 401(k) plans provide a single workplace benefit that meets the needs of all employees regardless of where they are on their financial journey. With GuidePlan, you no longer have to hope that people will attend your webinars or watch your video content. All participants receive a personalized plan that inspires and encourages them to take their next step.

Features

With GuidePlan

Without GuidePlan

What You Get With GuidePlan

GuidePlan’s intelligent 401(k) plans provide a single workplace benefit that meets the needs of all employees regardless of where they are on their financial journey. With GuidePlan, you no longer have to hope that people will attend your webinars or watch your video content. All participants receive a personalized plan that inspires and encourages them to take their next step.

With GuidePlan

401(k) Plan

Auto-Enroll

Auto-Escalate

Traditional & Roth Retirement Savings

Modern Secure 2.0 Plan Design

Tax Free Hardship Withdrawals

Access to Payday Alternative Loans

Student Loan Repayment with Match

Debt Management Programs

Access To Affordable Credit & Loan Products

Ability to Save For Major Life Events

Personalized Video Coaching & Content

Smart Videos Delivered By Phone Or Email

Turnkey Solution to Financial Wellbeing for All

Without GuidePlan

401(k) Plan

Auto-Enroll

Auto-Escalate

Traditional & Roth Retirement Savings

Modern Secure 2.0 Plan Design

Tax Free Hardship Withdrawals

Access to Payday Alternative Loans

Student Loan Repayment with Match

Debt Management Programs

Access To Affordable Credit & Loan Products

Ability to Save For Major Life Events

Personalized Video Coaching & Content

Smart Videos Delivered By Phone Or Email

Turnkey Solution to Financial Wellbeing for All

Schedule A Live Demo To See How It Works

Schedule a quick demo to see GuidePlan in action. Our team will answer any questions you might have.